From: The Congressional Integrity Project

To: Interested Parties

Date: October 16, 2020

Re: It’s Time to Investigate Ron Johnson and His Adult Children’s Finances

——————————————————————————————————————————-

For a year, Ron Johnson has treated the Senate Homeland Security and Governmental Affairs Committee as if it were a subsidiary of the Republican National Committee.

The Lugar Center at the University of Indiana recently gave Johnson’s committee an “F,” based on the degree to which its oversight hearing record in this Congress is on pace to match its historical performance.”

According to the Committee’s website it has issued fourteen press releases since August. Of those releases:

- Thirteen involve President Trump’s 2016 election or 2020 reelection campaigns;

- Seven focused on Hunter Biden;

- Seven promote Fox News interviews; and

- None relate to COVID; the domestic terror plots to kidnap governors, foreign influence of elections or any number of important issues that the committee has jurisdiction over.

While Johnson is fixated on investigating political opponents (and in-turn clumsily trying to aid President Trump’s reelection prospects), there has been remarkably little scrutiny of Johnson’s own troubling financial practices, which are intermingled with that of his three adult children.

The Trust

Senators are required to make regular personal financial disclosure filings so the public can examine their finances for conflicts of interest.

Ron Johnson has structured his finances in such a way that obscures his true wealth and investment holdings from the public, dodges taxes and allows his children to cash in on their family name. Before Johnson joined the Senate, he established the “The Ronald H. Johnson And Jane K. Johnson Irrevocable Endowment Trust.” While Johnson’s adult children – Jenna, Benjamin, And Carey – are the Trust’s legal beneficiaries, Ron Johnson is benefitting.

Here are a few examples:

- When in Washington, Johnson lives in a $1 million + row house owned by the Trust, which he pays rent to.

- Johnson’s three adult children own a private-jet company that appears to be owned by the Trust. The Milwaukee Journal Sentinel recently reported that Johnson has been using the private jets to shuttle him to and from Washington during the pandemic. It is unclear if Johnson followed Senate Ethics rules while using his children’s jet for official travel.

Since we know Johnson is benefitting from the Trust he set up for his children, why won’t he disclose what assets are in the Trust? What conflicts of interest may exist and how might Johnson avoid paying taxes as a result of this opaque financial arrangement?

Johnson’s Adult Children Profiting off the Family Name

According to state records, Ron Johnson’s children used the trust to buy an investment property from a Johnson donor and in-turn garnered special treatment from a state organization run by another Johnson donor, which enabled them access to millions of dollars in tax credits. Earlier this week,the Campaign for Accountability, a government watchdog group, filed an ethics complaint with the Wisconsin Ethics Commission to investigate whether Ron Johnson’s children benefited from preferential treatment when they received millions of dollars in state tax credits despite violating state rules.

This filing follows a recently released report by the Congressional Integrity Project that first detailed the Johnson’s children’s special treatment.

Rigging the Tax Code & Profiting

Senator Ron Johnson made headlines in 2017 when he initially opposed the Trump administration’s signature policy initiative, the Tax Cuts and Jobs Act. Johnson only agreed to vote for the bill after achieving a significant tax deduction for pass-through entities, which significantly lowered Johnson and his wife’s tax liability and increased their after-tax earnings.

This change also had the effect of increasing the value of Pacur, the plastics company Johnson founded. And sure enough, according to a newly uncovered document, just two months after the bill was signed into law by President Trump, Johnson quietly reached out to Wells Fargo to put his stake in Pacur up for sale. The sale, to private equity firm Gryphon (which also benefited from provisions of the tax bill) was completed and first disclosed by Johnson in March 2020.

Pass-throughs weren’t the only provision of the tax law that benefited the Johnson’s. The tax law also included a windfall for private jet owners – like the company that Johnson’s children own.

Johnson: Profiting off DC

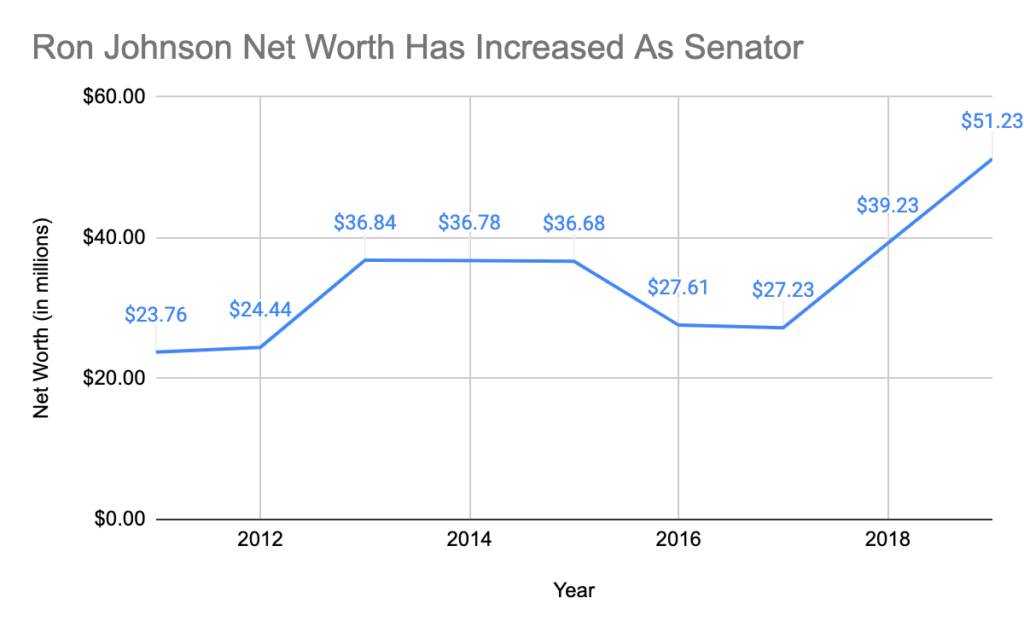

Since he was sworn into the Senate in 2011, Johnson’s likely net worth has increased by more than 115%. His estimated net worth in 2019 was between $18,101,013 and $84,366,000, which averages $51,233,506.50, making Johnson one of the richest Members of Congress.

His net worth increased by an estimated 30.6% from 2018 to 2019 after he leveraged his position to secure a massive tax-break for pass-through businesses (which had made him as much as $24.2 million between 2009-2018).

Before Ron Johnson staked his Committee Chairmanship on a partisan campaign to investigate the finances of his political opponents’ families, he should have taken a long look in the mirror.

We urge Senator Johnson to participate in any investigation of how his children received preferential treatment to get millions in tax breaks, disclose the holds in the Trust he benefits from and release his personal tax returns and the Trust’s tax filing to show how he may have benefitted from the tax proposals he fought for.

###